Do the mining global Goliath's really have an advantage? Beware the return of the Market Miners and a bit on Failure.

Do the mining global Goliath's really have an advantage? Beware the return of the Market Miners and a bit on Failure.

It’s true there is more MGDP (Mining Gross Domestic Product) than there was ten years ago. This though only draws more attention to the fact that mining as a business is no different to any other business sector and in fact the passage of human life in some ways.

Once you become a big company, or, an old person;

- Risk taking is often replaced by the need for increased certainty.

- Being allowed to explain (or just not explain) mistakes - on youthful naivety, is replaced by an expectation that you will use your experience to 'get it right'.

- Having an idea at breakfast and implementing it in the afternoon, is replaced by the need to work through the budget process.

- And about 30 other boring slow dull things that others demand of us when we mature.

I afford them respect but I would not want to be BHP or Rio Tinto for anything. That said we need them as examples of companies that endure. This excellent article found on “Digital Tonto” talks more about how large companies leverage their advantages to stay on top.

At the other end of the spectrum are of course the mining or exploration minnows, which require a considerable amount of entrepreneurship.

As we get older though, this clearly gets harder.

Assuming you want to keep mashing your hard won experience in with a great idea - and continue to take risks even after you have "invested" in children, or you get past 55, you have to constantly remind yourself of the core concepts of entrepreneurship including;

- Being prepared to tell your shareholders to walk if they don't like your business plan.

- This requires the capacity to put aside a % of your personal or your companies funds that you are willing to lose in a high risk but potentially high reward enterprise.

- Having a truly unique idea that no one else has. It is a difficult concept for many people to grasp that most successful start-ups have NO competitors. Of course within five years there will usually be plenty of copy cats.

- Being able to clearly explain the idea and the risks to investors.

Being the tenth person to get on board of a mineral that is the latest "hot thing", that's never created a producing mine in the past, is not entrepreneurship. It is (in my view) a different thing all together. I do not claim ownership of the term but some call it “market mining".

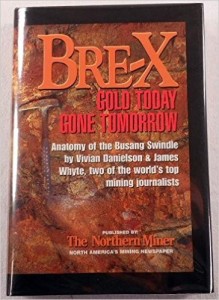

This book is of course about the famous swindle where senior company executives, put gold from a different place, into some exploration samples before sending them to the laboratory. The assay results were extraordinary of course and resulted in an incredible run up in the Bre-X share price, before eventually follow up drilling and assaying, showed there was no gold in the project at all.

This is a big, obvious example of large scale fraud and most people would clearly recognise this as unethical behaviour. Most market miners are nowhere near as obvious, but they have serial track records of talking a great talk, sometimes bending the truth, while never explaining the risks.

In many cases they truly believe their own story.

People who invest in these market miners without doing their background checking (which isn’t that hard with our easy access to information today) probably mostly deserve to be fleeced.

With markets at cyclical lows, I predict we will see a few market miners emerge in the next stage of this cycle. As an employee or an investor, beware and consider things like ...

Are the chances of success higher from investing in a business led by someone who owned 60% of the business and drawing a $100,000 salary (and needing the $100k to make ends meet), than a business led by someone owning 1%, being paid $500,000 pa?

Now I know there are many other factors and there are many great mining companies out there led by people in the latter category, however it is a worthy question to consider particularly in the "minnow" space.

To all the investors out there reading this, if I touched a nerve let me say that I have made these mistakes myself. As a business we need to be careful to avoid unethical clients who have a track record of using their suppliers money to fund their business and as investors we need to be wary of avoiding the market miners.

If you’re a senior executive looking to join a new flashy company, as I've commented previously, you have but one reputation to ruin!

We all need to do our homework - it is not that hard.

So lastly, on failure ...

Being young and a temporary (and it is ALWAYS temporary) failure is easy but being "experienced" and a failure, is humiliation for many.

The people in mining I admire most are those who I know to be super smart / super ethical people who just lucked out because of the vagaries of ore bodies, weather, or the impossibility of predicting global commodities or exchange markets. There is a massive amount of stuff totally outside the control of a lot of mining exec's and sometimes even super smart guys and girls get it wrong. I admire the ones that take it on the chin, explain it properly and come back.

As always, over the next few years there is potential for some huge wins, but there are also significant risks. If you're not the entrepreneurial type you probably know this yourself. If you’re not sure, then ask mentors you have seen do it and who know you at least a little. If it is clear it isn’t for you then you probably shouldn’t go there. You will just create stress for yourself, produce angry investors and clog up the system with just another failure. If you are, then go for it, always acting with integrity. If you don't do this last bit then other influencers in the market will use their new found capacity through social media to call you out. With more people doing the right thing this next stage could be a truly exciting era and I predict in many jurisdictions it will be one-off smaller mines creating bigger relative profits. The Mining Engineer in me just popped his head up there. So ‘cheers to the ethical mining entrepreneurs' and 'damn the market miners'.

Steve Heather Managing Director & Principal Executive Search Mining People International