Demand for skills in the mining industry is picking up, especially in Western Australia.

Commodities are still on that rollercoaster ride with most metals up and down over the past 3 months. We have provided a ‘then & now’ update below, but if you haven’t been following commodities lately, take a look at the links below to see what we mean by rollercoaster!

Commodities

Iron Ore – As at the 31st March, iron ore was $78.92US/t; by mid-July we saw it sitting at $65.59 US/t, so a major decline over the past 3 months.

Gold – On the 31st March, gold was at $1249.31 US/oz; as of this writing it sits at $1246.00 US/oz. It’s just like leaf gold – flat!

Nickel – On 31st March, nickel was at $4.50 US/lb. After being hammered in April and May, it weighs in at $4.34 US/lb.

Copper – On 31st March, copper was hovering around the $2.62US/lb and increased slightly to $2.72 US/lb at the end of July.

Zinc – Finishing March at $1.27 US/lb and then taking a tumble to nearly $1.10 US/lb, zinc climbed back to $1.26 US/lb by the end of July.

So, whilst there are other commodities not mentioned here, this key group gives us an indication of the market, in a general sense.

Last quarter we asked if there appears to be some belief in the prices holding. It seems they are but not advancing with any kind of confidence.

What is demonstrated is how this impacts our business.

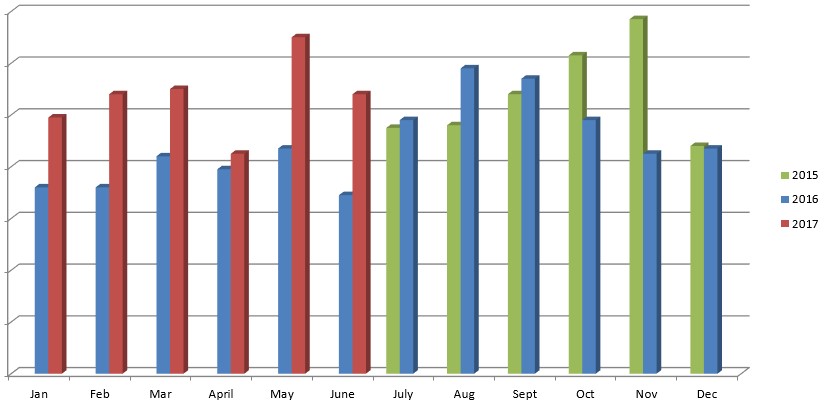

As you can see from MPi’s job opportunity statistics below, the market somewhat reflects the commodity prices. Over the past three months our growth has been flat, albeit off the back of a great turnaround in the January – March quarter.

Job Opportunities coming in to MPi

(Percentages quoted are relative to the previous quarter)

| Total | |

| Apr – Jun 2017 | +02% |

| Jan – Mar 2017 | +15% |

| Oct – Dec 2016 | -22% |

| Jul – Sep 2016 | +29% |

| Job Flow |

|

We’re not sure this demonstrates a belief that commodity prices will hold or move forward in 2017 but there appears to be some underlying confidence. We hasten to add this confidence is tainted with a fair degree of caution; we’re certainly not seeing the same expenditure of the boom times.

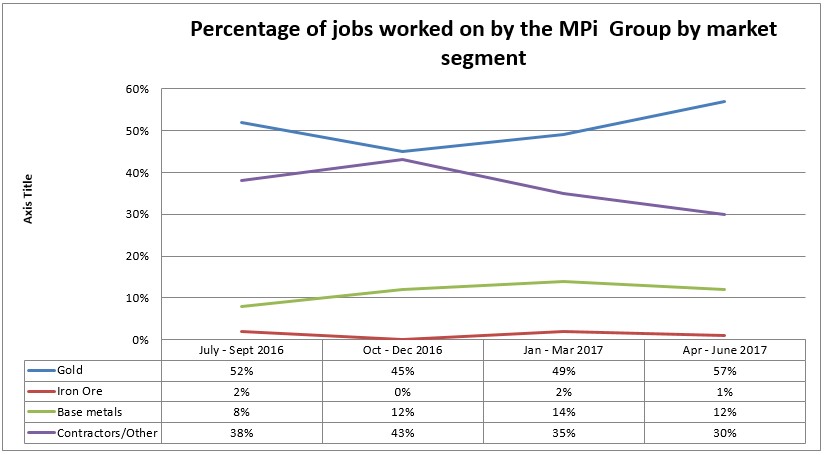

Market Segment Activity

All that glitters is gold this quarter!

We have seen a willingness for our gold clients to take on more work in-house versus bringing in contractors to complete smaller projects. A broad cross section of the gold mining community is hiring again. We are seeing candidates being more active in the market and they are changing jobs for other opportunities. This activity essentially creates the hiring cycle again. Contractor vacancies took another dip, however, as mentioned in last quarter’s report. We think this is an aberration and will not be a long-term drop.

Candidate commentary

Professional Technical – FIFO Perth & Residential Kalgoorlie

Last quarter we said the market had tightened and it continues to do so. We recommend businesses review their recruitment strategies to ensure they can attract people in a candidate-tight environment. This means making sure your advertising is targeted and appealing, your processes are streamlined, and you keep people moving through your process. For example, don’t let your candidates wait weeks for feedback. Finally, we recommend you have a search mechanism backing up your advertising. Without incorporating search into your professional technical recruitment in the current market, you are definitely missing out on good candidates.

As some of the projects we mentioned last quarter ramp up their recruitment, the demand for professional people will intensify. Some of the major projects that are scheduled to start in late 2017 or 2018 include:

- Gruyere – Goldfields/Gold Road

- Pilgangoora – Pilbara Minerals

- Silver grass – Rio Tinto

These are just three of the larger projects; we are aware of up to five others likely to start in the same time frame.

Will it get back to the boom days of 2010/2011?

Let’s hope not, but now certainly is the time to prepare for a tight candidate market. It’s definitely just around the corner, if not already here in some disciplines.

Workforce – FIFO Perth:

Open Pit – We’re experiencing high demand for experienced operators across the industry, driven by the gold space but also iron ore is still hiring.

Underground – The available candidate market is tough. We are noticing some companies ramping up and winning new contracts, not only in WA but in the eastern Australian states as well.

Trades - Electricians are in high demand with mineral processing plant experience. Mobile trades experienced personnel are always in high demand and cautious about their next move.

Processing – The trend of experienced gold/base metals candidates being available but looking at slightly higher rates has continued. There are candidates around and available regardless.

FIFO Perth general - There has been a noticeable increase in candidates looking to get back into mining after three or four years out of the industry. They are coming back with expectations of higher pay rates. Rosters and pay rates are now becoming more competitive and candidates have more options and choice.

Workforce – Kalgoorlie Residential:

Open pit – There is continued strong demand across most of the Kalgoorlie. Open pits have really depleted the candidate pool.

Underground – Over the past three months we have seen the candidate pool improve, but they are not on the market for long.

Trades – Same as the previous quarter, mobile trades across the board are hard to source. Fixed plant trades are still available.

Processing – Lab & Met tech candidates have good people available. Process tech candidates are out there however they are only seeking long term work.

Geo-techs (Field, Pit, Core yard techs) – It’s getting to the point where these candidates are as hard to find as a 10-year experienced HD Fitter. Well not quite, but they are in very short supply.

Kalgoorlie general – With fewer new faces arriving into Kalgoorlie, shortages still remain and look to continue across the surface, trades and geo-tech fields. Underground has turned around slightly, mainly due to the fact some local sites have had scheduled cutbacks.

Overall Summary

Yes, things are picking up – there is no doubt about that now. But we believe the lesson of the boom times and the subsequent downturn have been learnt.

The challenge now is to not forget what we know and ensure we don’t get carried away with the positive sentiment. The industry is demanding high-caliber individuals that can add value regardless of the commodity price and market conditions. We get the sense that capital markets are taking a ‘wait and see’ approach with the junior end of town, but our expectation is it will continue to move in a positive direction.

For a bit more on where the industry is headed, have a look at our recent article based on the PwC 2017 mining report.

So, we’re into MPi’s 22nd year and we look forward to seeing the industry continue to grow. We have no doubt there will be bumps in the road, but regardless of what 2017 throws at us we’re confident the innovation and resilience of our industry will find a way to make it work.

As always we are open to hear what kind of information and data you are seeking about the market. We have access to a broad range of statistics that we’re happy to share with our clients. Please help us improve this update by dropping us a note at brad.thorp@miningpeople.com.au or shane.moore@miningpeople.com.au with your ideas. In the meantime, if you want a more detailed idea of what’s happening in your specific sector of the market, please give us a call at (08) 9426 1500.