A former treasurer says mining had only a small role in Australia surviving the GFC unscathed. Is he right?

Former Australia treasurer Wayne Swan raised a few hackles in the mining industry in August this year when he made a claim that the country surviving the global financial crisis had nothing to do with the last great mining boom.

And fair enough, according to industry experts and the ABC’s Fact Check unit.

What happened during the GFC

The “GFC”, as it is known in Australia, was actually a global recession caused by subprime mortgages in the United States. That is to say, it was about bad debt. When investment bank Lehman Brothers collapsed in mid-2008, it triggered an international crisis, as banks and investors around the world were exposed, and stock markets crashed.

Australia, though, did not experience recession. At the height of the GFC in 2009, with global economies embroiled in the biggest crisis since the Great Depression of the 1930s, Australia sustained 1.8 per cent economic growth.

It’s the credit for that incredible result which is now up for debate.

Mr Swan’s argument, nearly 10 years after the crash, was that it was the then federal Labor government’s response to the GFC — the stimulus packages it launched — that helped the country safely navigate treacherous economic waters. It had little to do, he said, with China’s incredible growth and high demand for Australia’s mineral resources, like iron ore.

What happened to Australian mining during the GFC

So the argument then becomes one about what happened to Australia’s mining industry during the GFC. Here’s how former treasury secretary Ken Henry (who helped guide Mr Swan’s policies during this period) put it:

“In the first six months of 2009, in the immediate aftermath of the shock waves occasioned by the collapse of Lehman Brothers, the Australian mining industry shed 15.2 per cent of its employees,” he said.

“Had every industry in Australia behaved in the same way, our unemployment rate would have increased from 4.6 per cent to 19 per cent in six months. Mining investment collapsed; mining output collapsed.”

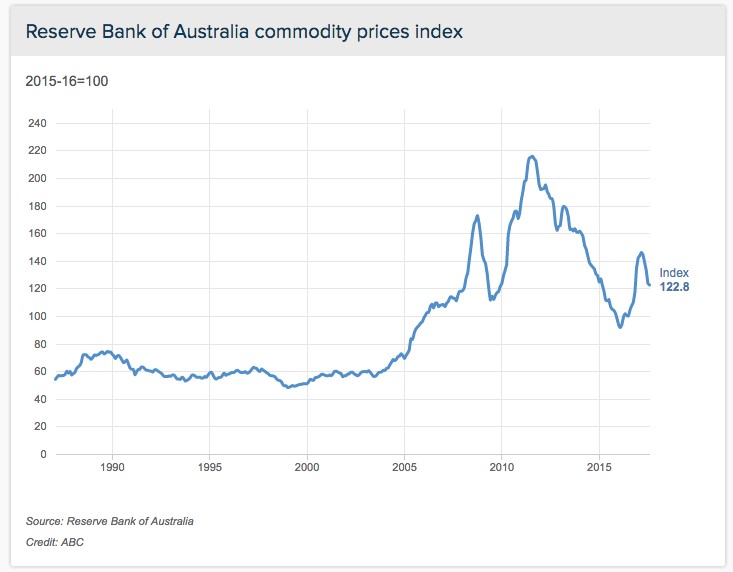

But here’s a graph from the Reserve Bank of Australia and ABC’s Fact Check showing commodity prices in Australia in the period leading up to, including, and after the GFC.

While it shows a slump in commodity prices at the worst period of the GFC (second half of 2009), it also shows a sharp increase of commodity prices in the four years leading up to the crash. That rise had been fuelled by Chinese demand for commodities.

Three components to Australia’s GFC economic success

Michael Grant, senior client advisor at Bell Potter Securities in Western Australia, puts it this way: “There are three components (to Australia surviving the GFC) and certainly mining and the secondary effects of the mining boom — which includes consumer confidence and mining confidence — helped.”

“The stimulus did help partly but wasn’t entirely responsible for it.

“There was certainly a factor of luck in there as well in terms of Australia’s diminished exposure to subprime mortgage failures. The subprime infection wasn’t endemic to Australia, whereas in other countries it was.”

Mr Grant said the Chinese reaction to the GFC was to stimulate their economy and that maintained — and possibly increased — their demand for commodities.

“So that had quite a strong effect on our confidence levels,” he said.

So, what’s the verdict?

The ABC’s Fact Check unit reached the same decision, saying Mr Swan’s claims were “over the top”.

“While mining investment, commodity prices and mining jobs fell during the key period of the global financial crisis, experts told Fact Check that the mining boom placed Australia in a strong economic and fiscal position ahead of the crisis, and helped accelerate the post-crisis recovery,” the ABC Fact Check said.

“Lending a hand were a low exchange rate and stimulus spending in China, which helped sustain mining exports during the crisis.

“Mr Swan is entitled to say his government's swift and decisive response was a key reason Australia did not follow most of the developed world into recession.”

And let’s not forget mining investment during the GFC

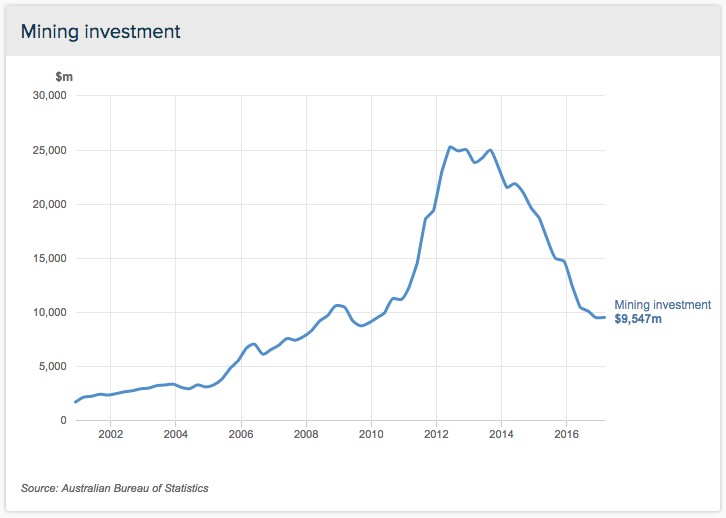

The ABC had one more graph that is really instructive. It shows mining investment during the period concerned.

It shows a drop in mining investment during the worst period of the GFC that is barely a blip compared to the stratospheric investment that flowed from the industry in the years following the crisis. That represents a huge number of jobs — including, as anyone around at the time would recall, a large number of very highly paid jobs — and a massive boost to the economy.

As the Reserve Bank estimated and the ABC noted, “the last mining boom raised real per capita household disposable income by 13 per cent, raised real wages by 6 per cent and lowered the unemployment rate by about 1.25 percentage points.”

Perhaps, then, it’s no wonder many in the mining industry were a bit annoyed with Mr Swan’s claims about mining’s role in saving the Australian economy during the GFC?

Mining in Australia is once again entering an investment phase and there are mining jobs available across the country. If you’re keen to get your start in mining, or want to test the mining employment marketplace, get in touch with the team at Mining People International.