A new report suggests the resources sector is set to remain a major contributor in the Australian economy.

Australia’s last boom was largely driven by the enormous investment in the resources sector — and much of that activity occurred in Western Australia.

But following the industry’s downturn in recent years, and this year’s slow recovery, what role will the resources sector play in Australia’s future? Well, according to a new report, it looks set to remain a major player in WA’s economy at the very least.

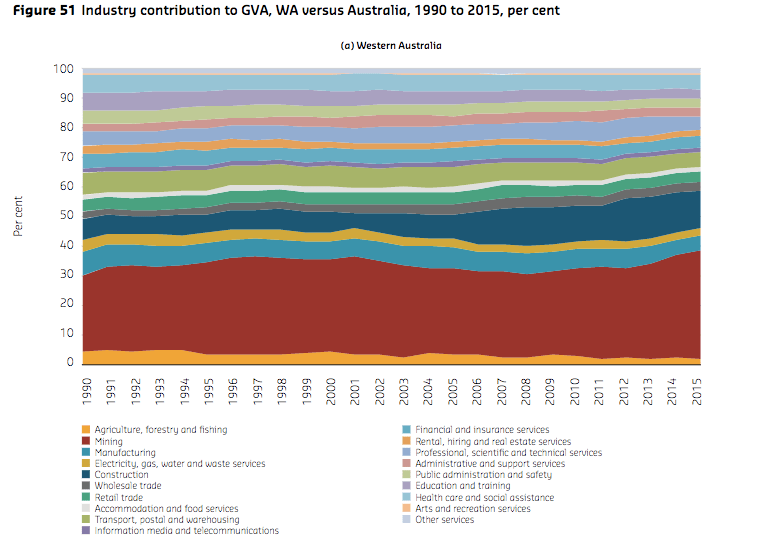

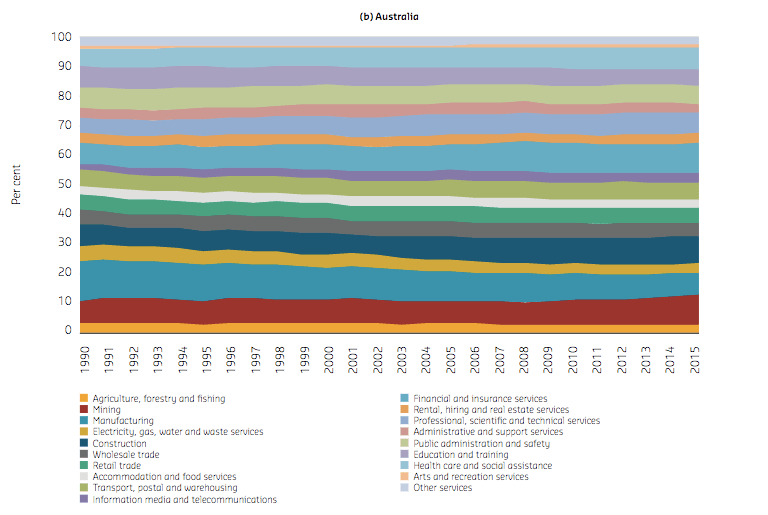

Earlier this month the Bankwest Curtin Economics Centre released its latest Focus on WA study, looking at incomes and employment in the State. It closely examined the post-boom contribution of the mining industry to the WA economy relative to other industries including agriculture, manufacturing, construction, financial and insurance services, electricity, gas, water and waste services, wholesale trade, retail trade and accommodation.

The report uncovers the extent of economic diversification that has taken place outside the resources sector since its growth slowed but clearly demonstrates mining, oil and gas are still going to be major players in WA’s economy.

Here’s the chart from 1990 to 2015. It compares the gross value added (GVA) across industries to gauge each industry’s relative contribution to the state’s output. GVA is typically used to describe the contribution of each industry to the gross product of the economy.

“As indicated by the red-shaded area, mining has clearly been a dominant industry in WA and its share has increased from around 25 to 37 per cent between 1990 and 2015,” the report states. “However, on an Australia-wide basis, the share of mining has only increased very mildly from around seven to nine per cent,” the report states.

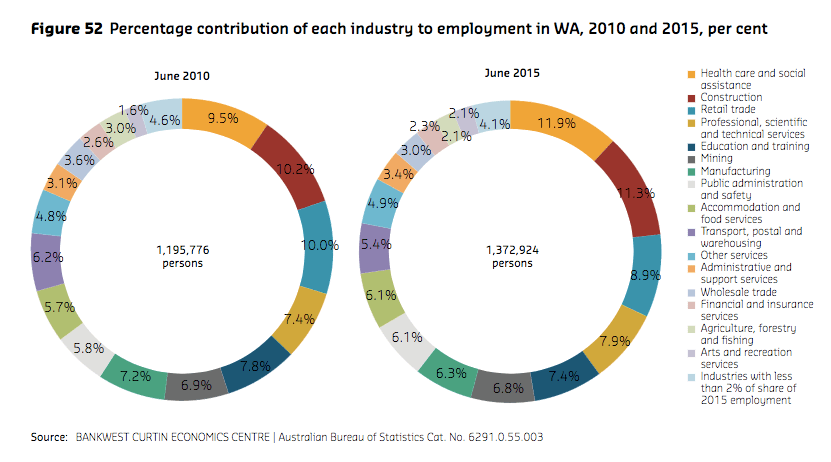

The contribution of each industry to the WA economy can also be measured by its contribution to total employment in the state.

The next chart displays the percentage contribution of each industry to the state’s employment. The total number of persons employed across all industries was 1.4 million in 2015 compared to 1.2 million in 2010. By comparing each industry’s share of employment in 2010 and 2015, the report’s editors were able to assess the extent to which each industry’s contribution to the state’s employment has changed since the slowdown of the resources sector.

While the mining industry was the primary contributor to the state’s GVA in 2015, it accounted for only seven per cent of the state’s employment in that year. The report authors found a comparison of employment shares across both years suggested the slowdown of the resources sector had done little to alter the distribution of employment across industries.

The report dispels any notion that the mining industry has receded in importance to the state — despite lots of talk of an increasingly diversified WA economy.

“Indeed, the slowdown of the resources sector has done little to alter the distribution of GVA across industries,” the report states. “The mining industry continues to maintain its dominance in the WA economy… However, there is some evidence of diversification taking place within the mining sector itself”.

The report concluded by warning: “Western Australia is entering a critical phase in its economic trajectory after the boom. The state’s prevailing narrative for economic development has been built around a strong resources sector, combined with a diversified industrial development strategy promoting growth in other sectors of the economy. Agriculture, food and tourism feature strongly in this narrative, but are these sectors well enough positioned, or of sufficient scale, to continue the state’s growth story?”

So the resources sector is set to remain a major part of the WA economy, and a major source of employment, into the future.